Factors To Consider With Moving Averages

This is part 3 in our series that is covering moving averages. You can check out the other two What is a moving average and How to use a moving average.

Data Used in Calculation

Most moving averages will use the closing prices of a given asset and then factor them into the calculation. We thought we would mention this is always not the case as it is possible using the open, close high or median to calculate the moving average. You will only see slight differences using each method which can have a little impact on your analysis.

Finding an Appropriate Time Periods

Most moving averages are the average of all the daily prices. The time frame does not always need to be in days as moving averages can be calucated in minutes, hours, weeks, months etc. Day traders will use a 50 minute moving average and a long term holder will use a 50 day moving average.

No Average is Foolproof

As we all know nothing in the financial markets are for sure. If a coin bounces off a support of a major average we would all be rich. One of the maor disadvantages of moving averages is that they are useless when you are trending sideways.

Responsiveness to Price Action & Lagging Indicators

Traders that are using moving averages will admit that there is a challenge when you are trying to make a moving average responsive to changes in trend while not allowing it to be so sensitive that it causes a trader to prematurely enter or exit a position.

Short-term moving averages are useful when you are trying to identify trends before a large move occurs. The negative side of this is that the technique can lead to being “whipsawed” because the averages respond quickly to changing prices. is that this technique can also lead to being whipsawed in and out of a position because these averages respond very quickly to changing prices. We recommend using this with other technical indicators.

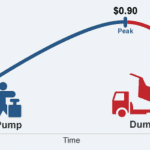

Moving averages are a lagging indicator. What this means is that the signals will occur after the price moved enough in one direction to cause the moving average to respond. A lagging characteristic can work against you. It can cause you to enter into a position at a bad time. Our next section will cover trading strategies and how to apply them using moving averages.

Stay Tuned!

-AboveCrypto Team